Articles

HUDCO Loans @ 12.5% Interest rate PointLESS and Hurt More

Date: 8th Aug 2018

Hudco, a fully government owned for-profit entity, was started in 1970, prior to the 1991 economic reforms. It was responsible for financing the housing and infrastructure development projects. After 1991, money availability in India changed dramatically. It has to be noted that debt is not a go to solution for every problem. Individual debt is a person’s personal business, but government debt is everybody’s business.

If we absolutely HAVE to go into debt, the lowest available interest rate loan with an earliest payoff possibility should be chosen very carefully.

It's a conflict of interest when Governments can avail such debt to lure voters and retain their power. Money distribution schemes will become prevalent but they also end up dividing the people in showing preferential treatment to some over others. In fact, the Telugu states were divided under this pretext.

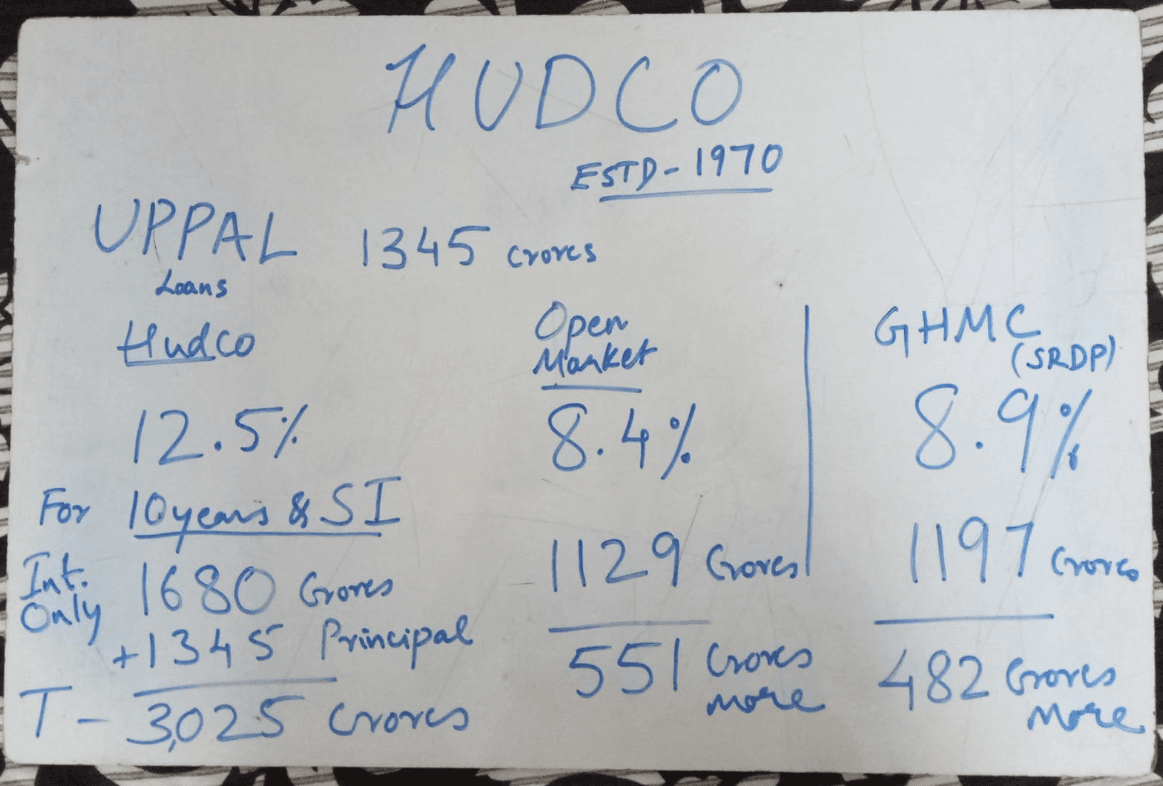

Hudco offered Telangana government an interest rate of 12.5% on their loans. Which is much higher than rates available in the open markets ( around 8.4%); making these loans very expensive on the borrower. GHMC borrows at 8.9% from open markets.

In case of Uppal MLA constituency, Hudco loans worth 1345 crores, hurt us more than they help. Telangana state has to pay 12.5% Interest rate on these loans. They hurt the Telangana state economy, especially when there are open market options that are available for lower interest rates.

Existence of obsolete institutions and laws still/will continue to hurt the country.

The entire interview is added below.